Vatican: Moneyval Report Is Published, the Evaluation Is Positive

Statements of the President of the ASIF

The Vatican is “pleased to receive the Moneyval Report published today and the stimulus to continue the path undertaken,” said a note published today, June 9, 2021, by the Holy See Press Office.

“With the recognition of the efficacy of the measures adopted by all the interested organisms in the fight against money laundering and the financing of terrorism, the Holy See’s Authorities assure their commitment to continue on the path of full compliance with the best international parameters and to do so, they will evaluate carefully the recommendations contained in the Report,” ends the text.

Positive Evaluation

Moneyval’s Report on “mutual evaluation” is a document of over 200 pages that certifies periodically compliance with the principal international standards in the matter of the fight against money laundering and the financing of terrorism. It is the first time that Moneyval reports on the Vatican and Holy See’s efficacy in fighting against money laundering and the financing of terrorism.

In an interview with “Vatican News,” Carmelo Barbagallo, President of the Supervisory and Financial Information Authority (ASIF) indicates that in each point of evaluation of the efficacy, Moneyval expresses a judgment, divided on four levels: ‘low,’ ‘moderate,’ ‘substantial’ and ‘high’ efficacy. The Vatican’s jurisdiction received five ‘substantial’ efficacy ratings and six ‘moderate’ efficacy ratings. In no case was there a low efficacy rating.”

Barbagallo also said that but for “one exception, Moneyval has not expressed up to now judgments of ‘high’ efficacy and that those of ‘substantial’ efficacy are scarce. Moreover, it must be taken into consideration that the ratings of ‘substantial’ efficacy were obtained by the Vatican’s jurisdiction on very important aspects, namely, on international cooperation, on supervision, on the financial system, on juridical persons and on the fight against the financing of terrorism.”

Among the many factors that have led to a positive result, mentioned is made of “the incisive action of stimulation and coordination carried out by the Financial Security Committee, headed by the Secretariat of State’s Adviser for General Affairs.”

Summary of the Moneyval Report (from the Italian).

Aspects to Improve

Conversely, Moneyval also highlighted aspect to improve, among which are that of justice, in particular the speed of the processes and the dissuasive effect of sentences in the Vatican. “The judgment expressed on this aspect is of ‘moderate’ efficacy,’ said ASIF’s president, which means that some “corrective actions are necessary to achieve a more profound improvement.”

To assess this judgment well, “it must be taken into account that none of the countries subjected to the last round of evaluation of Moneyval obtained better ratings (of ‘substantial’ efficacy or ‘high’ efficacy). On pointing out the more critical aspects as, for example, the duration of the investigations, the Report itself acknowledges that the efficacy of the Vatican jurisdiction depends on the efficacy of foreign jurisdictions and the speedy furnishing of the relevant information requested for carrying out its investigations.”

Finally, in his statements Barbagallo pointed out that the “recommendations expressed in the Moneyval Report regarding the Vatican’s jurisdiction, are a stimulus to make it even better, always keeping high the quality of the human resources employed and reinforcing the activity of all the Authorities involved in the fight against money laundering and the financing of terrorism.” They are “suggestions that help the Vatican to contribute to the realization — in conditions of the greatest transparency and financial correction –, of the ultimate objective of the mission of the Church.”

Moneyval

The Committee of Experts for the Evaluation of Measures against money Laundering and the Financing of Terrorism (MONEYVAL) is an organ of permanent control of the Council of Europe in charge of evaluating compliance with the principal international norms of the fight against money laundering and the financing of terrorism and the efficacy of their application, as well as of formulating recommendations to the National Authorities on the improvements necessary in their systems.

MONEYVAL hopes to improve the capacities of National Authorities to fight more effectively against money laundering and the financing of terrorism, through a dynamic process of mutual evaluations, peer reviews and regular follow-ups of its reports.

Related

Thousands of faithful bid farewell to Pope Francis in St. Peter’s Square

Exaudi Staff

26 April, 2025

2 min

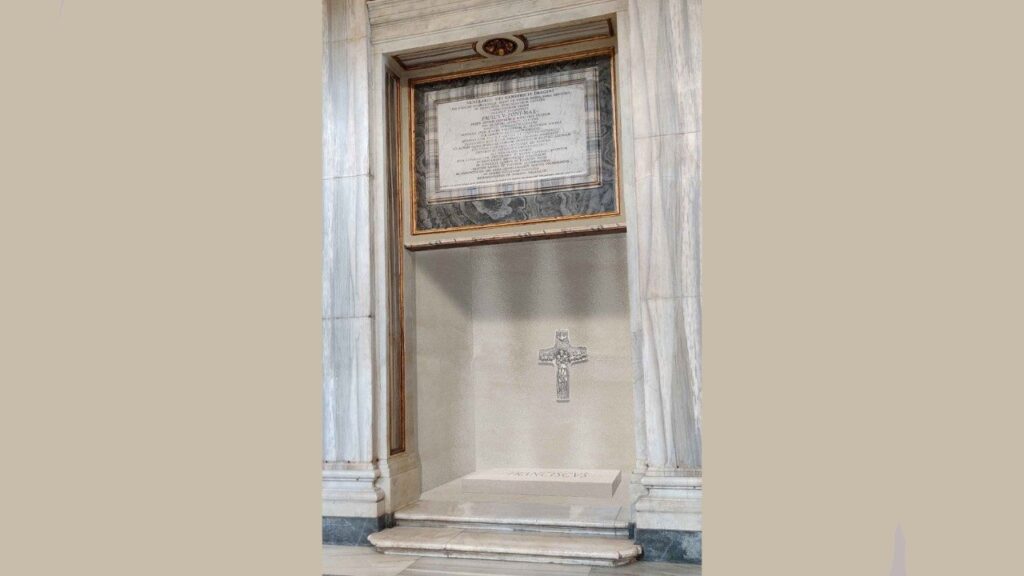

Francis’s Tomb: A Legacy of Humility and Closeness

Exaudi Staff

25 April, 2025

4 min

Cardinals Intensify Their Spiritual and Pastoral Preparation at the Third General Congregation

Exaudi Staff

24 April, 2025

1 min

Rome unites in prayer: the world bids farewell to Pope Francis with love and gratitude

Exaudi Staff

24 April, 2025

2 min

(EN)

(EN)

(ES)

(ES)

(IT)

(IT)